Additionally, in the aftermath of AIG's statement on the management changes, the Bermuda-based insurer Ironshore, Inc. announced on January 6 that Joe Boren and John O'Brien have joined a newly established Environmental Insurance division of Ironshore in New York City, with Boren as CEO and O'Brien as President.

AIG senior reinsurance executive Charles Dangelo has left the insurer to join a company run by its former CEO Maurice "Hank" Greenberg.

Dangelo joins the growing number of executives who have left American International Group Inc. since the insurer was first bailed out by the U.S. government last September.

He has been named chief executive for Starr Indemnity & Liability Co., chief executive of Starr Excess Lines Insurance and director and chairman of Starr Insurance and Reinsurance, all subsidiaries of Starr International Co.

Greenberg said in a statement on the appointment that Dangelo would help Starr International to develop its property/casualty business.

Rates for property-casualty coverage are rising after several years of declines, spelling opportunity for well-capitalized companies in the sector. Insurers' and reinsurers' ability to write new business is dictated by how much capital they can afford reserve for future claims.

AIG said it had no comment on Dangelo's departure.

Greenberg has been ramping up his operations since last year, hiring more staff and entering a joint venture between C.V. Starr and Bermuda insurer Ironshore Inc, called Iron-Starr Excess Agency Ltd. Ironshore has recruited several executives from AIG.

In recent months, other former AIG executives have joined Zurich Financial Services Group, Ace Limited and privately-held Ironshore.

AIG says Greenberg "responsible" for collapse

| Greenberg questions whether Fed overpaid for toxic AIG securities |

(Reuters)—Maurice “Hank” Greenberg, former American International Group boss, has questioned whether a Federal Reserve Bank of New York fund, charged with taking on some of the troubled insurer’s toxic holdings, paid the right price for some packaged debt securities.

Mr. Greenberg, a top private shareholder of the insurer, wrote a letter to AIG CEO Edward Liddy in which he said he is interested in knowing more about a sale of $39.3 billion of assets to the fund, announced by the company on Monday.

In the transaction, the fund bought securities held by the insurer’s counterparties. Mr. Greenberg refers in the letter to reports the CDOs were purchased by the fund at face value, and notes the securities had likely been marked down by the counterparties. He added that AIG had marked the CDOs down to about 50%of face value.

“It certainly seems it was very good for the counterparties,” wrote Mr. Greenberg in the letter.

The fund, Maiden Lane II, was created to hold mortgage liabilities from an AIG securities lending portfolio that caused huge losses to the troubled insurer, the company said in a press release on Monday.

The New York Fed extended a loan to Maiden Lane II to enable the purchase of the securities for $19.8 billion.

Maiden Lane LLC was an entity established to take on the toxic assets of Bear Stearns when it was purchased by JP Morgan. Bernanke hired Blackrock to oversee the pool. During his Senate Finance Committee confirmation hearing on January 21, Timothy Geithner said he said that he thought Maiden Lane's disclosure was "adequate."

On December 29, the central bank's Board of Governors wrote a report to Congress saying that it didn't expect “any net loss to the Federal Reserve or taxpayers” from the Bear Stearns holdings.

It hasn't worked out that way:

Feb. 4 (Bloomberg) -- U.S. taxpayers may be stuck with losses on $30 billion of Bear Stearns Cos. assets owned by the Federal Reserve even though the central bank has said otherwise, according to Robert A. Eisenbeis, Cumberland Associates Inc.’s chief monetary economist.

“There is no prospect for a profit on the assets,” Eisenbeis wrote in a report yesterday. “Losses are mounting.”

The CHART OF THE DAY illustrates the extent of the losses since June, when the Fed began providing data on the holdings’ value. The biggest declines were recorded after quarterly mark- to-market adjustments.

Last week’s total was $4.22 billion, as shown in the chart. JPMorgan Chase & Co. is responsible for the first $1.15 billion under terms of an agreement completed in June, when the company took over Bear Stearns. The Fed picks up the rest.

“The transaction was not structured with adequate over- collateralization

DEALBOOK

Where was Geithner in turmoil?

But Geithner's involvement in several ultimately ill-fated efforts to buttress the American financial system is the very reason some Wall Street CEO's — a number of whom spoke on the condition of anonymity for fear of piquing the man who regulates them — question whether he's up to the challenge.

"We have only two things to say about Tim Geithner, who we do not know: AIG and Lehman Brothers," said Christopher Whalen of Institutional Risk Analytics. "Throw in the Bear Stearns/Maiden Lane fiasco for good measure," he said, referring to the site of the New York Federal Reserve, where many rescue discussions took place.

"All of these 'rescues' are a disaster for the taxpayer, for the financial markets and also for the Federal Reserve System as an organization. Geithner, in our view, deserves retirement, not promotion."

Ouch.

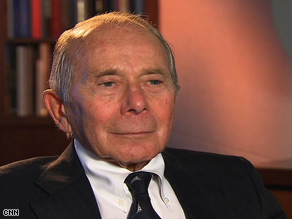

By David Fitzpatrick

CNN Special Investigations Unit

NEW YORK (CNN) -- The ex-CEO of the battered insurance and financial services company AIG said Wednesday the bonus plan for executives at his old firm was slipshod in recent years, with employees frequently leaving after receiving retention bonuses.

Former AIG CEO Maurice Greenberg says employees got retention bonuses and could still leave the company.

"You get a retention bonus and there was no handcuffs on that," said former CEO Maurice "Hank" Greenberg. "You get a retention bonus and you can leave the next day. There was no commitment, somebody saying, 'You have to stay.' And many people left. They took the bonus, said thank you and left."

Greenberg was ousted from the company in 2005, after more than 30 years as its chief, in the middle of a New York state investigation into its accounting. But he remains the largest single shareholder in AIG, which has been kept alive after massive losses from complicated financial instruments tied to real estate, and he filed a securities fraud lawsuit against the company earlier this month.

A year ago, he launched a campaign to replace all AIG board members, who he said had done a poor job. In his interview with CNN, Greenberg said directors gave themselves a significant pay raise after he left the company.

"It makes me feel terrible," he said. "This was the biggest, greatest insurance company in history."

Greenberg reportedly takes Fifth at inquiry

Regulators question deal with Buffett's General Re

NEW YORK - Maurice R. "Hank" Greenberg took the Fifth Amendment "dozens of times" when he was questioned yesterday about possibly illegal transactions between the giant insurance firm he headed for nearly 40 years and a unit of Warren E. Buffett's Berkshire Hathaway Inc., sources told Newsday.

Greenberg, 79, who stepped down last month as chief executive officer of the world's largest insurer, American International Group Inc., invoked his right against self-incrimination to all questions except his name during an approximately 45-minute session with state and federal regulators, the sources said.

The session took place at New York Attorney General Eliot Spitzer's Broadway offices. Regulators from the New York State Insurance Department and federal prosecutors also questioned Greenberg.

Brad Maione, a spokesman for Spitzer, declined to comment. Robert Morvillo, one of Greenberg's lawyers, also declined to comment.HELLO FOLKS....WE HAVE PAID ALMOST TWO HUNDRED BILLION, AND OBAMA/GEITHNER ARE HELPING MAURICE GREENBERG STEAL AIG, MOVE THE WHOLE CRIMINAL INSTITUTION INTO A NEW SHELL WHILE LITIGATION AROUND HIS CRIMINAL ACTIVITIES SWIRLS....HE JUST NEEDS TO KEEP BUYING MORE TIME AS HE PICKS THE AIG CARCASS CLEAN.

"AIG is in crisis," Greenberg's letter said.

An AIG spokesman, Chris Winans, said the company received the letter on Monday, and had forwarded it to members of the board. The board said Monday evening that it saw no need to postpone the shareholder meeting.

Greenberg's letter follows a lawsuit filed last week by Starr International, a company that Greenberg controls, against AIG and its chief executive, Martin Sullivan, as well as Steven Bensinger, who on Thursday announced he would step aside as chief financial officer to assume another position at AIG

The suit, filed in New York State Supreme Court in Manhattan, claims that the insurer fraudulently misrepresented its exposure to credit default swaps, and seeks to recover at least $300 million in damages.

Greenberg, who parted ways with AIG in 2005 amid an accounting scandal, is chairman of C.V. Starr and Starr International, which were once affiliated with AIG, and are still the insurer's largest shareholders.

9 comments:

Now that we know all about what happened to 1/1000th of the taxpayer money given to AIG, we can assume that the other $179.8b has been managed just as wisely. But the media and AIG and Geithner are doing a good job of keeping us from looking at that.

t's such a important site. cool, quite interesting!!!

-------

[url=http://oponymozgowe.pl]Opony Mozgowe[/url]

[url=http://pozycjonowanie.lagata.pl]Pozycjonowanie[/url]

[url=http://www.umocnij.pl/zdrowie,i,uroda/opony,s,3471/]opony[/url]

Thank you Office 2010

.I hope Microsoft Office 2010

I can improve Microsoft word

through learning this respect Office 2007

. But overall, it's Microsoft Office

very nice. Microsoft Office 2007

Thank you Office 2007 key

for Office 2007 Professional

your share Microsoft outlook 2010

!Thank you Windows 7.I hope Microsoft outlook

I can improve Office 2007 Professional

through learning this respect. But Office 2007 download

overall, it's very nice. Thank you Office 2007 key

for your share!

Goldin, who is a vegetarian, keep in shape.chi flat iron It also takes a tap class, which she says is a good way to implement in their schedule forchi flat irons classes must be included.

And a little more sun in your face expression, Onysko offers a few deep breaths and stretches in the morning.

"This will be your blood boil and add color to the face," said Onysko. chi flat irons discount"This is your natural tone of the game and help you feel better."

top [url=http://www.001casino.com/]001casino.com[/url] check the latest [url=http://www.casinolasvegass.com/]online casino[/url] autonomous no set aside bonus at the foremost [url=http://www.baywatchcasino.com/]loosen casino

[/url].

You really make it appear really easy along with your presentation but I

to find this topic to be really something that I feel I would by no means understand.

It kind of feels too complex and extremely huge for me.

I'm taking a look ahead to your subsequent submit, I'll attempt to

get the hold of it!

Feel free to visit my blog post :: jeremy scott adidas

my webpage - jeremy scott adidas wings

Hi, i think that i saw you visited my website thus

i came to “return the favor”.I am trying to find things to improve

my website!I suppose its ok to use a few of your ideas!

!

Stop by my blog: Christian Louboutin Daffodile

You really make it appear so easy together with your

presentation but I to find this matter to be really one

thing that I think I'd never understand. It sort of feels too complicated and extremely extensive for me. I'm looking ahead on your subsequent

put up, I will try to get the dangle of it!

my site ... Ray Ban Outlet

Excellent goods from you, man. I've understand your stuff previous to and you are just extremely magnificent. I actually like what you've acquired here, certainly like what

you are stating and the way in which you say it.

You make it entertaining and you still care for to keep it

sensible. I can not wait to read far more from you. This is actually a terrific website.

My homepage: nike air max 95

Post a Comment